The Denver Real Estate Review | August 2025

Boots on the Ground

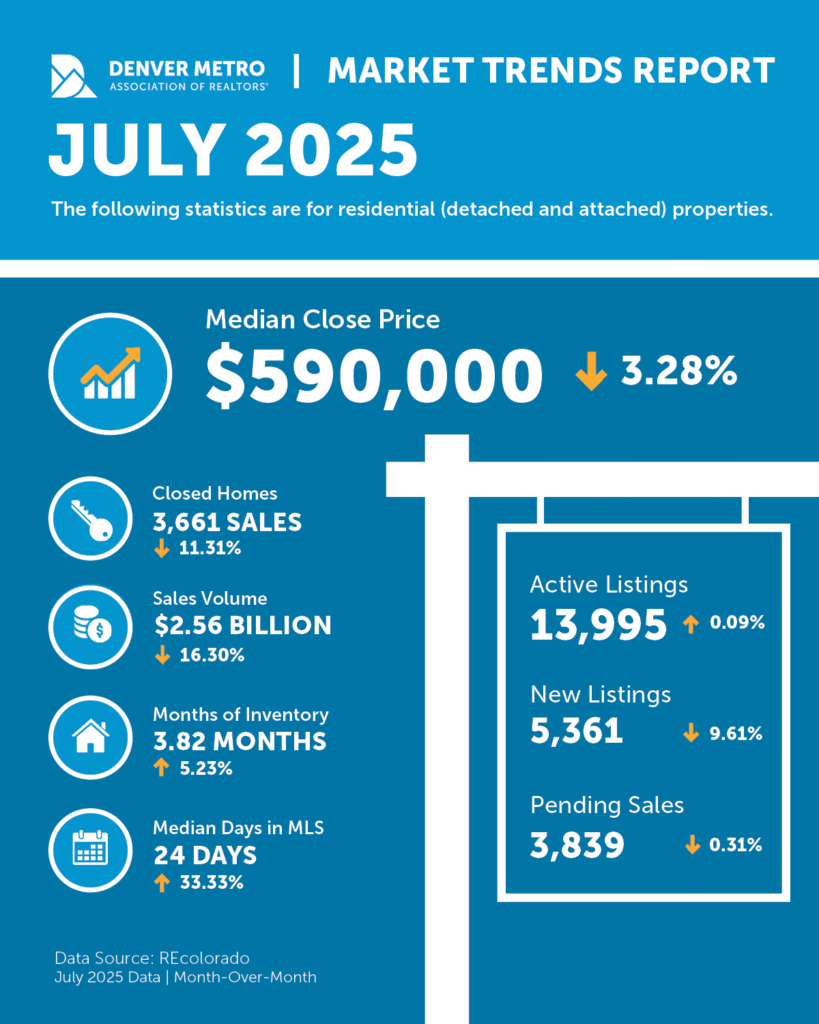

The headlines for the Denver real estate market in July will be a lot of fun now that the data is catching up with the reality on the ground. Listings that battled through the spring market – with price reduction after price reduction – are starting to close.

As expected, home price data went negative as a result, both month-over-month and year-over-year, with over 55% of homes closing at a reduced price.

It’s not unusual to see negative month-over-month price data in July since this is the time of year when the ugly ducklings from the spring market start to close, but it’s a notable change that I’m sure will cause a stir.

The market dynamics haven’t really changed all year though – any buyer, seller or agent can attest to that. Buyers are still chasing the “shiniest bauble” on a very large shelf, while all the other baubles scramble to make themselves shinier with things like:

- Aggressive price reductions

- Updates and Staging

- Incentives for things like mortgage rate buy-downs

Even so, the disconnect between price and affordability is still wide and none of the above is moving the needle enough to stimulate meaningful increases on the demand side of things.

I will say, in just the last 2-3 weeks I’ve been having a lot more conversations with potential buyers than potential sellers – so who knows – maybe these headlines will bring out some of the deal seekers that should 100% be taking advantage of this market.

Broader Economy

Meanwhile, the great American trade war seems to have everyone’s brain in a pretzel, especially those at the Federal Reserve. They held firm on not reducing the Fed funds rate on July 30th, while they monitor the effects that tariffs might have on inflation.

This announcement was followed the next day by a jobs report that showed significant downward revisions to the jobs numbers from the past two months – significant enough that had this been announced the day prior it’s almost guaranteed the Fed would have reacted with a rate cut.

The jury is still out on whether a Fed rate cut would help or hurt mortgage rates in the near term, but historically, these cuts do play a big role in bringing mortgage rates down.

The market seems to have priced that in at this point (rates dropped to around 6.5%) and will likely continue to do so unless the Fed comes out and says they won’t reduce again in September.

That seems unlikely at this point and even if that were the case, Trump will probably be announcing a new Fed Chair in the next few weeks as Jerome Powell ends his term in May.

Once that happens the bond and mortgage markets will ignore anything Powell has to say and focus on the policies of the new Chair, who wouldn’t be getting the job without agreeing that cuts need to start happening.

Time will tell if that’s good or bad for the rest of us. Until then, we seem to be back on track for mortgage rates to make a steady march lower. Take that with a grain of salt. Last time I said that the tariff situation came out of left field and stopped us in our tracks.

Understanding these dynamics is the key to making a smart move, whether you’re buying, selling, or investing. If you’d like a clear strategy tailored to your goals, I’m here to help you navigate the path forward.

Click below to schedule a no-pressure consultation, or simply reply to this email with your questions. Remember, if you have too much real estate, or not enough, I can fix that for you!

Financing Snapshot

Mortgage rates have been much less volatile so far this year, making small sustained moves downward. While everyone is focused on the Fed reducing the Fed Funds Rate – the effect on mortgage rates from that could disappoint without real stress in the economy.

Right now, that isn’t the case, but the market does seem to be pricing in some easing from the Fed. As long as the tariff debacle doesn’t prove inflationary, expect rates to keep moving slowly down to the low 6% or even high 5% range by the end of the year.

Market Insights

Market Insights

The 11% drop in the number of closed homes stands out here – but it’s not too unusual for a July market to be extra slow compared to the rest of the year.

We’ll see if we get our usual end of summer bump, but I expect we will with both prices and mortgage rates coming down at the same time.

I don’t think it’ll bring home prices back into the green across the board, but you never know.

If you like to negotiate – this is the market for you!! Right now, the list price is simply a suggestion.