The Denver Real Estate Review | September 2025

Boots on the Ground

If Denver’s real estate market has felt a bit stagnant this year, you’re not wrong.

But while the overall pace has slowed, the opportunities to get creative and make some great deals have increased dramatically – and it will only get better going into next year.

One exciting trend that I’ve picked up on – and have been working on with both buyers and sellers – is the power behind assumable loans. This is where a buyer can take over an existing loan from a seller, including the existing mortgage rate, which is especially powerful when that mortgage rate is, say, 2.5%…

These don’t come without their challenges, and the majority of mortgage loans are not assumable – generally being limited to FHA or VA loans – but I’m seeing this being utilized more and more with savvy buyers and sellers.

The reason for its growing prominence is clear: many homeowners who secured incredible sub-4% rates feel “locked in.” They want to move, but giving up that rate for a new one in the current market feels like a major financial step backward. So, they’ll seek to replace it by assuming another low-rate loan.

This situation creates a unique opening for sellers to use their low-rate loan as a massive selling point, attracting buyers who might otherwise be sitting on the sidelines.

Offering an assumable loan isn’t just a gimmick; it’s a powerful marketing tool. It can make their property stand out, justify a higher asking price, and create a smoother transaction with a highly motivated buyer.

For buyers, the benefits are even more direct: a much lower monthly payment (often to the tune of $500-$1000+ per month) and the ability to pick up the loan wherever it is in the amortization schedule.

Since the majority of interest is paid within the first half of the loan cycle, even taking over a loan from 2020 can mean skipping tens of thousands of dollars in interest and building equity much faster.

The 2%, 3%, or even 4% loans from 2020-2022 will prove to be a once-in-a-generation opportunity, and strategies like this can be a powerful tool for anyone that may have missed that window.

The market is shifting, and those who adapt will win.

As the real estate landscape changes, yesterday’s rules no longer apply. Whether you’re a homeowner feeling ‘locked in’ by your low rate or a buyer struggling to make the numbers work, creative solutions are the key to success.

Don’t leave money on the table. Schedule a no-obligation strategy session with me today, and let’s build a personalized plan to leverage these unique market conditions and achieve your real estate goals.

Financing Snapshot

Mortgage rates saw some of the biggest declines since last year, with the expectation that they will continue to fall as the Fed Reduces rates in the coming months.

As long as inflation doesn’t start heating back up, we should see modest, but steady and sustained declines in mortgage rates going into next year.

Fingers are firmly crossed!

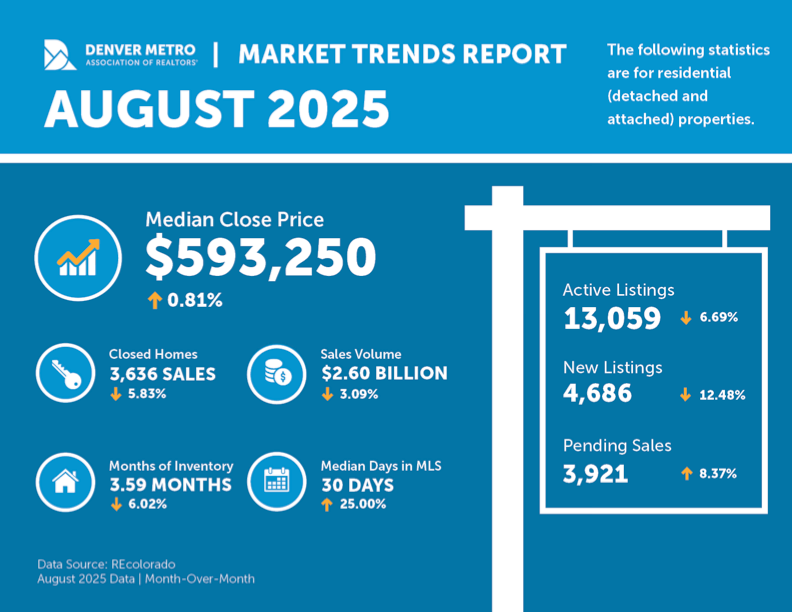

Market Insights

The Denver Metro housing market in 2025 is characterized by a persistent stagnancy. While the market isn’t making dramatic moves, the underlying story is complex.

For most of the year, prices have remained stable, and buyer activity has closely mirrored levels seen in 2024. Despite ongoing affordability challenges due to interest rates, there haven’t been significant shifts in buyer or seller behavior, making the market appear quiet and predictable on the surface.

A closer look at the key market indicators for August reveals these modest trends. Price adjustments have been minimal throughout the year, with the median closing price for detached homes seeing a slight decrease of 0.15% and attached homes decreasing by 1.28% in August.

Concurrently, the median time on the market increased by six days for both property types. The most significant contrast appears in inventory levels. While 45,868 new listings have come on the market in 2025—a 10.49% increase year-over-year—the number of active listings has climbed even more significantly, up 21.77%.

Despite this surge in available homes, buyer demand has remained consistent, with the number of closed sales nearly identical to 2024 levels.

A major division has emerged between homes that are priced correctly from the start and those that are not. This data clearly shows that while median closed prices are stable, sellers are testing the limits of buyer tolerance.

Of the properties that closed in August, only 1.12% required a price reduction, with a small median adjustment of just 2.95%. In contrast, 58% of homes currently on the market have already reduced their price, with a more substantial median drop of 4.52%.

The trend is even more pronounced for homes lingering on the market for over 30 days, where 74% have undergone a price cut with a median reduction of 4.76%.

Homes priced appropriately sell quickly with minimal negotiation, whereas overpriced homes tend to sit on the market longer and require more significant price cuts.

As we move into the fall season, little change is expected in the market for the remainder of the year. September is often a volatile month, and any potential interest rate cuts from the Federal Reserve could introduce more uncertainty for mortgage rates. Broader economic factors like unemployment, inflation, and tariffs could also counteract the intended benefits of a rate cut.

Ultimately, a stagnant real estate market is not necessarily a simple one. The raw data alone does not capture the complete picture. To navigate the current Denver market successfully, it is essential to understand the trends and the story they tell about real-world buyer and seller decisions.